Understanding the esports opportunity

January 17, 2020Rohini Sardana speaks to iGaming Business and outlines the challenges and opportunities presented by the burgeoning esports betting vertical

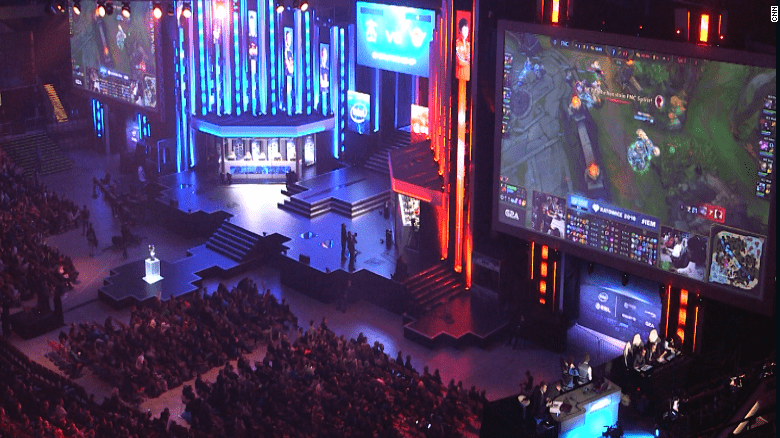

The continued growth of esports has presented a significant challenge and opportunity for mainstream operators, many of whom have been exploring how to optimise this relative newcomer to the betting landscape.

With market research providers such as Newzoo predicting a 14.4% compound annual growth rate of the global esports audience between 2016 and 2021 to approximately 307 million, bookmakers know that they cannot afford to ignore the vertical, especially given its significant engagement amongst younger demographics.

However, according to Rohini Sardana, the head of product propositions at SIS, the approach of just “cutting and pasting” esports events (with the accompanying data) to a sportsbook has not gained significant traction with bettors to date.

“Esports is a high growth sector and media coverage is at an all-time high, but the reality is that a lot of mainstream operators are finding it a challenge to translate this into significant revenues or profits,” Sardana says.

So, what are the challenges that esports face as a betting vertical, and how can operators combat them?

Complicated

Sardana says “Our market research into the current esports landscape revealed that with current esports betting events, there is a lack of engagement amongst existing sports bettors, who are more knowledgeable and comfortable with traditional sports events.

“If you look at streams of most esports – for example, Dota 2, the screens are very busy and the events can be complicated to price up, and the events last for a relatively long time, so it isn’t easy for a punter to dip in and out,” Sardana adds.

“If you ask any traditional sports bettor, they don’t yet fully understand these games and are unfamiliar with esports players and teams, which represents barriers to engaging with esports events and betting on them.

At this stage, she says, “There is also a fragmented network of rights across different territories, as well as different games, tournament formats and players, impacting the offer available to customers. Multiple data points in games and changes in player rosters as well as games updates, make it difficult to price up events, therefore, it can be hard to find traders with both the mathematical background and the understanding of the games and their many intricacies.”

Another necessity, Sardana says, is low latency between pictures and priceswhen pricing live events for online, which is essential for operators to maintain margins. Delays can inevitably raise questions from operators about the credibility of esports betting and its feasibility as a business proposition.

Read the Complete Story

Categorized in: Esports News